45 coupon rate treasury bond

Individual - Series I Savings Bonds - TreasuryDirect As of January 1, 2012, paper savings bonds are no longer sold at financial institutions. This action supports Treasury's goal to increase the number of electronic transactions with citizens and businesses. NEWS: The initial interest rate on new Series I savings bonds is 7.12 percent. You can buy I bonds at that rate through April 2022. Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Coupon rate treasury bond

Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more " refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the ... Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). Understanding Coupon Rate and Yield to Maturity of Bonds ... To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon rate treasury bond. Treasury Bond Futures - New York University Treasury Bond Futures 1 Treasury Bond Futures Basic Futures Contract Futures vs. Forward Delivery Options –Underlying asset, marking-to-market, convergence to cash, conversion factor, cheapest-to-deliver, wildcard option, timing option, end-of-month option, implied repo rate, net basis Concepts and Buzzwords Reading Veronesi, Chapters 6 and 11 Tuckman, Chapter 14 . … Solved: Which security should sell at a greater ... - Chegg A 10-year Treasury bond with a 9% coupon rate or a 10-year T-bond with a 10% coupon.b. A three-month expiration call option with an exercise price of $40 or a three-month call on the same stock with an exercise price of $35.c. A put option on a stock selling at $50 or a put option on another stock selling at $60. How to Read Treasury Bond Prices | Finance - Zacks A typical 10-year U.S. Treasury note is the 1.625 percent notes due Nov. 15, 2022. The 1.625 percent refers to the coupon rate of interest. Nov. 15, 2022, is ... Coupon Rate Definition - investopedia.com 05.09.2021 · A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value.

What Is Coupon Rate and How Do You Calculate It? Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. Treasury Coupon Issues and Corporate Bond Yield Curves | U ... Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. 30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year … US 10-Year Government Bond Interest Rate - YCharts Dec 31, 2021 · US 10-Year Government Bond Interest Rate is at 2.13%, compared to 1.94% last month and 1.61% last year. This is lower than the long term average of 5.93%.

Individual - Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) › markets › interest-ratesU.S. Treasury Bond Futures Quotes - CME Group 1 day ago · US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. US Treasury Bonds Rates - Yahoo Finance Stocks slide, tech shares lag as Treasury yields spike: Nasdaq drops 2.2%, S&P 500 sheds 1.7% Breaking News • Apr 11, 2022 Stocks drop as Treasury yields spike: Nasdaq down by 1% Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays. Monthly Treasury Statement ... Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. View This Data. Daily Treasury Par ...

› treasury-bondWhat Is a Treasury Bond and How Does It Work? - CFAJournal Thus, in a rising rate setting, a treasury bond could be subjected to the cost of opportunity, which means that the fixed rate of return could not work. While treasury bonds can be sold until they expire, the seller’s price may be below the initial bond-buying price. For instance, if a $2,000 Treasury bond was purchased and sold in advance ...

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. are an ...

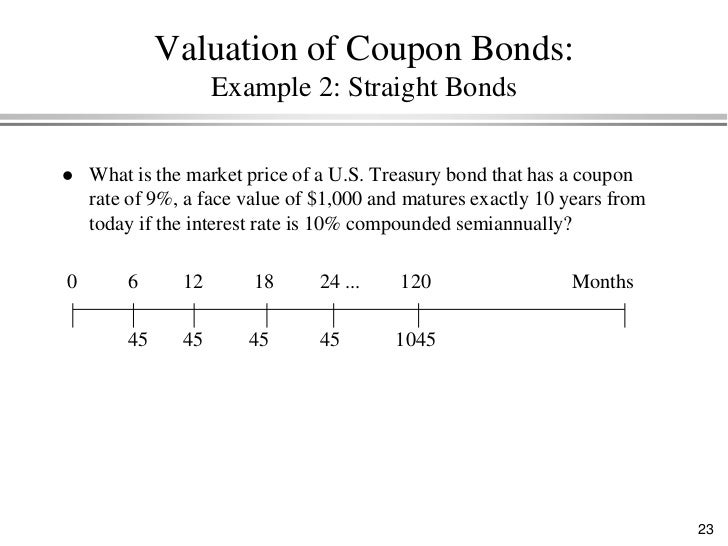

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

› terms › tTreasury Bills (T-Bills) Definition Dec 12, 2021 · T-bills do not pay regular interest payments as with a coupon bond, ... The Treasury yield is the interest rate that the U.S. government pays to borrow money for different lengths of time.

How does the U.S. Treasury decide what coupon rate to ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

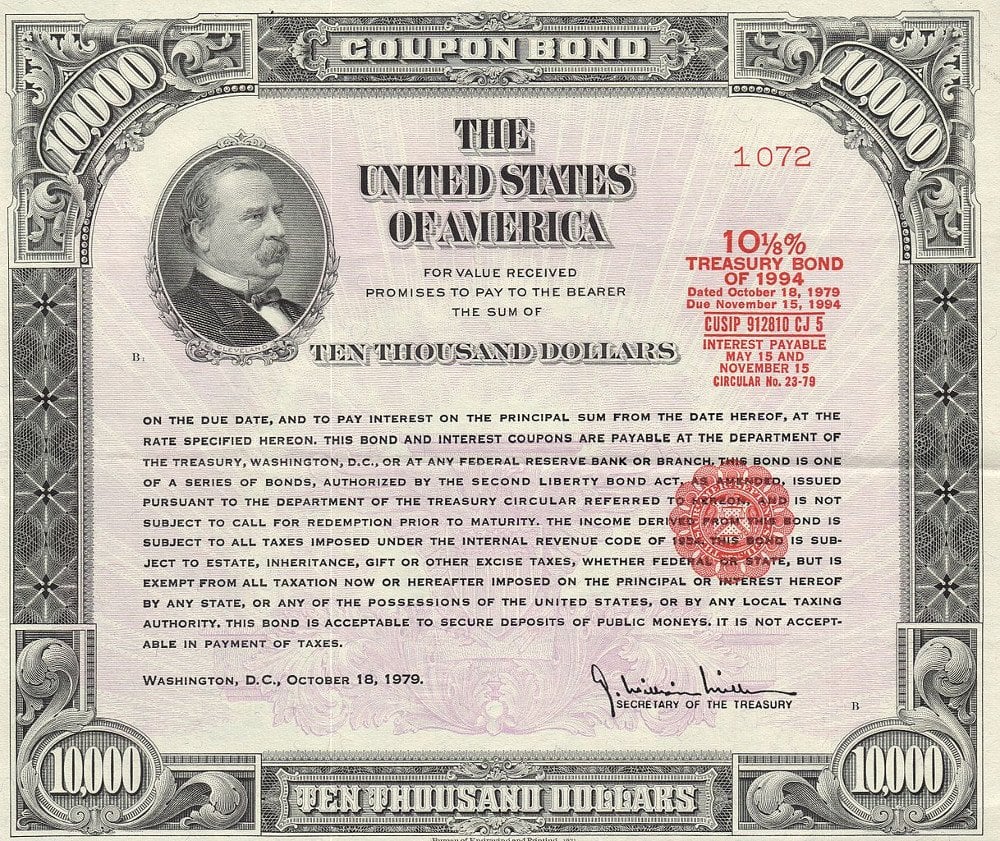

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

5 Year Treasury Rate - YCharts 19.04.2022 · The 5 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 5 years. The 5 Year treasury yield is used as a reference point in valuing other securities, such as corporate bonds. The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as …

U.S. 3 Year Treasury Note Overview - MarketWatch 10-year Treasury yield falls to lowest in two weeks, flattening the curve, even as Fed official sees need to quickly raise interest rates next year Dec. 17, 2021 at 4:00 p.m. ET by William Watts

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

US Treasury Bonds - Fidelity Investments The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline.

10-Year High Quality Market (HQM) Corporate Bond Spot Rate ... 10.04.2022 · The spot rate for any maturity is defined as the yield on a bond that gives a single payment at that maturity. This is called a zero coupon bond. Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them consistent with the yields on other high quality bonds. The HQM yield curve uses data …

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments remain...

Post a Comment for "45 coupon rate treasury bond"