40 are zero coupon bonds taxable

PIMCO Bond ETF List - ETF Database PIMCO Bond ETFs are funds that track various fixed-income sectors and segments of the global bond market. The bonds can be of various duration lengths, credit quality or type. Additionally, they can cover international and domestic bonds. The funds will actually hold the bonds in their underlying indexes and can include both passive and actively managed ETFs. Ch. 14 | StudyHippo.com The purchase and sale of government bonds by the Fed for the purpose of altering bank reserves is known as Fiscal policy. Federal funds operations. Open market operations. Zero coupon bonding. answer. ... Amount of money that is spent by changing tax policy. Amount of money that is spent by changing income transfers.

EDV | ETF Snapshot - Fidelity The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index. This index includes zero-coupon U.S. Treasury securities (Treasury STRIPS), which are backed by the full faith and credit of the U.S. government, with maturities ranging from 20 to 30 years.

Are zero coupon bonds taxable

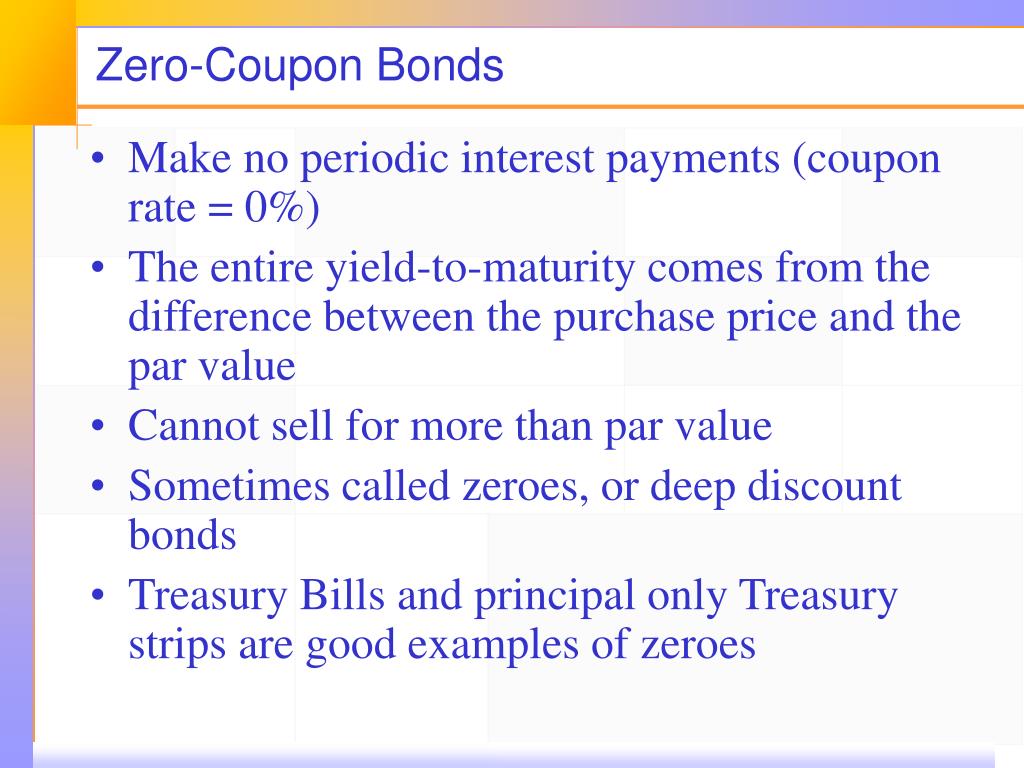

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. ICICI Direct The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor ... Tax Free Bond - REC Limited Tax Free Bond. ISIN-wise Details of Public Issue of REC Tax Free Bonds (351 KB) PDF. Procedure to claim Unpaid Principal/Interest (718 KB) PDF. Page Last Updated At: 17/06/2022 - 03:32 PM.

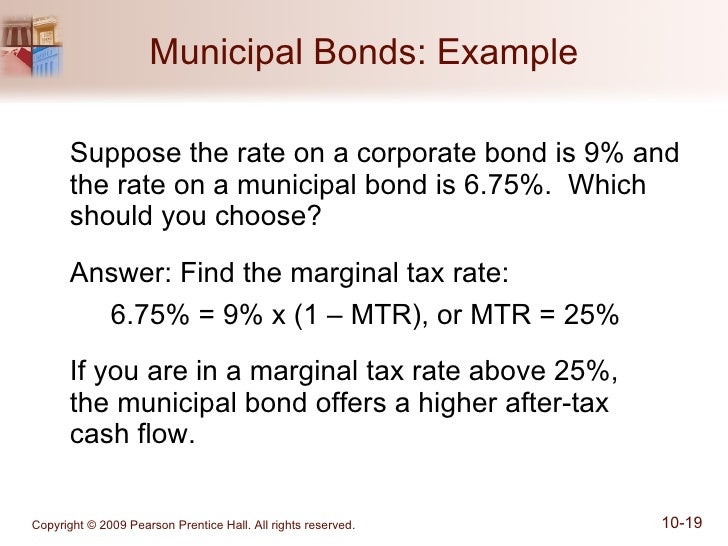

Are zero coupon bonds taxable. EGP T-Bills EGP Treasury Bill Auction According to the Primary Dealers System. Type (days) 182. 364. Auction date. 16/06/2022. 16/06/2022. Issue date. 21/06/2022. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing … May 01, 2022 · Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... Secondary Bonds Market – Types of Bonds India The income generated by the interest is usually non-taxable when you purchase tax free bonds. Know More. GOVERNMENT SECURITY. When the Government wants to borrow money to fund their projects, they involve the public to raise money. Know More. ZERO COUPONS. Zero coupon bonds are sold at discounted rates but don't pay interests. Know More. CONVERTIBLE BONDS. These are the bonds … TIPs are now a better buy than I-Bonds - Bogleheads.org That could be a reason to favor I-bonds v taxable TIPS but otherwise even taxable TIPS look better than I-bonds right now, a dramatic change in just a few months. ... This situation is logically the same as having multiple zero-coupon bonds. The two greatest enemies of the equity fund investor are expenses and emotions. ― John C. Bogle. Top ...

Income Tax for Foreign Investors - NSE India Taxes are inclusive of surcharge @ 2% wherever applicable and education cess @ 3% on the tax amount 12 months in case of shares held in a company or any other security listed in a recognised stock exchange in India or a unit of the UTI or a unit of a Mutual Fund specified under section 10 (23D) or a zero coupon bond. In all other cases 36 months. Factbox-Canadian lawmakers approve 2022 budget measures on housing ... A luxury tax on the sale of new luxury cars and aircraft with a retail sale price over C$100,000 ($76,964.52), and on new boats or yachts over C$250,000. A tax credit aimed at helping seniors and... PZA Invesco Exchange-Traded Fund Trust II - Seeking Alpha The fund does not invest in single-family housing, multi-family housing, tobacco, original issue zero coupon, rule 144A, taxable and AMT bonds. Invesco Exchange-Traded Fund Trust II - Invesco... LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest, if any. YTM computation is based on the Corporate Action dates available with the Exchange. Download the example for understanding of yield calculation

EDV - Summary of Vanguard Extended Duration Treasury ETF - ETF Profile ... The Bloomberg U.S. Treasury STRIPS 20¿¿¿30 Year Equal Par Bond Index includes zero-coupon U.S. Treasury securities, which are backed by the full faith and credit of the U.S. government, with ... Finance Archive | June 23, 2022 | Chegg.com 1. (12 points) Bond A is a semiannually compounded, zero-coupon bond with a face value of $1,000.00. At issuance, the market interest rate for bonds with a similar risk profile was 6.50%. For Bond A. 1 answer CAN YOU HELP ME TO FILL OUT THESE BOXES BECAUSE I GOT STUCK HERE Stock Market | Daily Herald Zero coupon risk is the risk that zero coupon bonds may be highly volatile as interest rates rise or fall. Senior floating-rate loans are usually rated below investment grade but may also be unrated. ... an investment in a Fund may be less tax-efficient than an investment in an exchange-traded fund that effects its creations and redemptions for ... Corporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable

EGP T-Bonds Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; Variable Rate Repo; FX Auction. ... EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 5: Auction date: 13/06/2022: Issue date: 14/06 ...

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Types Of Bonds: 7 Types Of Financial Bonds For [2022] 28.10.2021 · Within each type of bond, there are additional types, like high-yield bonds or investment-grade bonds under corporate bonds. There are also zero-coupon bonds. Here are seven of the most common bond types. Agency Bonds. Agency bonds are those issued to raise money by government-sponsored enterprises (GSEs) like the Federal National Mortgage Association (better known as …

Stock Market | Tamar Securities Financial Portal a dividend of $0.45313 per share of the 7.25% Series C Cumulative Redeemable Preferred Stock. The Series A, Series B and Series C preferred dividends are payable on July 27, 2022 to the applicable preferred stockholders of record at the close of business on July 12, 2022. Two Harbors Investment Corp.

Forms - REC Limited SEBI circular dated November 3, 2021 - Norms for furnishing PAN, KYC details and Nomination (231 KB) PDF. Form ISR - 1 - Request for registering PAN, KYC details or changes/updation thereof (913 KB) PDF. Form ISR - 2 - Confirmation of signature of securities holder by the Banker (166 KB) PDF. Form ISR - 3 - Declaration form for opting-out of ...

T. Rowe Price Review - Investopedia Bonds and CDs Treasury Auctions and Treasury Bills - $50 Agencies (FNMA, FHLMC), TIPS, Treasury and Coupon Notes and Bonds, and Treasury Zero coupon Bonds - $1 per $1,000 bond GNMAs and CMOs - $1...

Brazil Government Bonds - Yields Curve The Brazil 10Y Government Bond has a 12.839% yield. 10 Years vs 2 Years bond spread is -97.1 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 13.25% (last modification in June 2022). The Brazil credit rating is BB-, according to Standard & Poor's agency.

› corporate-bondsCorporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate.

Post a Comment for "40 are zero coupon bonds taxable"