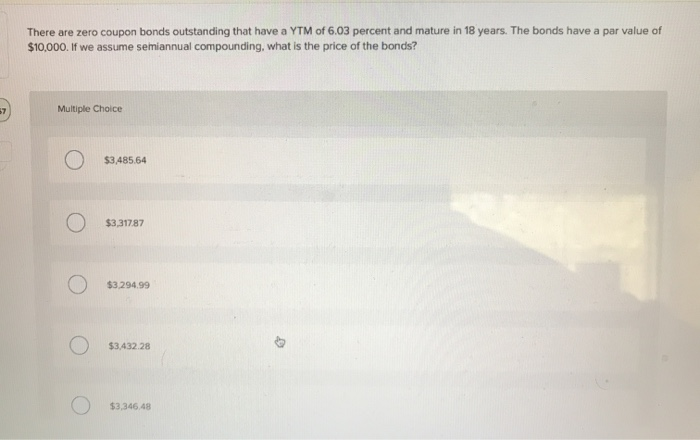

39 ytm zero coupon bond

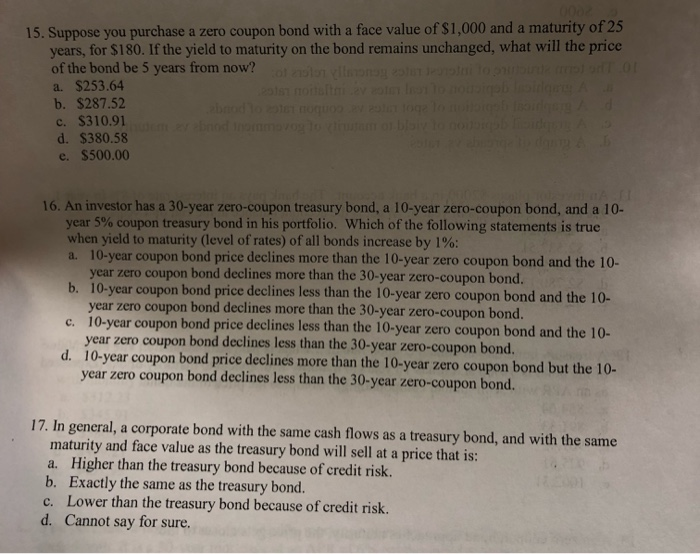

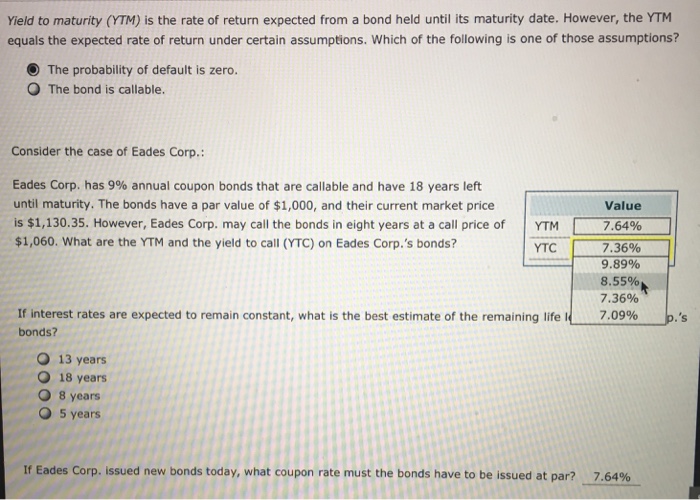

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Yield to maturity (YTM) is the expected return on a bond if it is held until maturity.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox YTM includes all coupon payments from an investment. But for a zero coupon bond, there are no coupon payments. The entire amount of money is received at the time of maturity. One can calculate the yield on them using the formula below. YTM for Zero Coupon Bond Where, Face value is the amount of money the investor receives upon maturity.

Ytm zero coupon bond

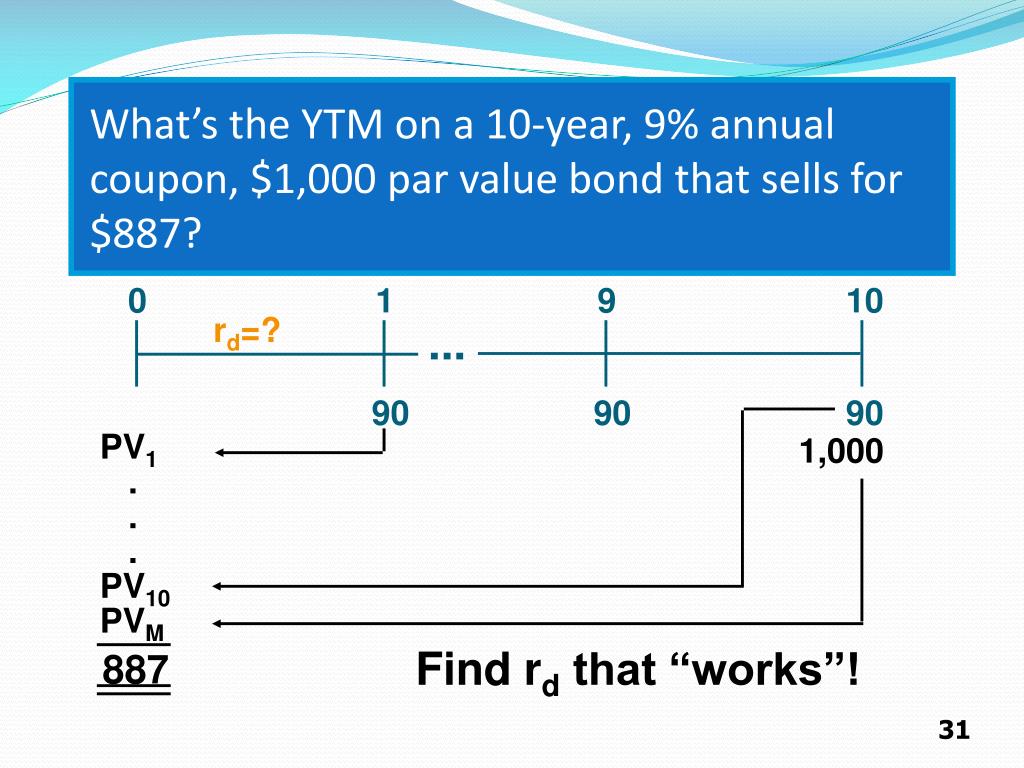

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube - Otosection Calculating yield to maturity on a zero coupon bond. ytm = (m p) 1 n 1. variable definitions: ytm = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) m = maturity value; p = price; n = years until maturity; advantages of zero coupon bonds. most bonds typically pay out a coupon every six months. What is the yield to maturity (YTM) of a zero coupon bond with a face ... YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 -> Nper that is the number of payments in this case 8.

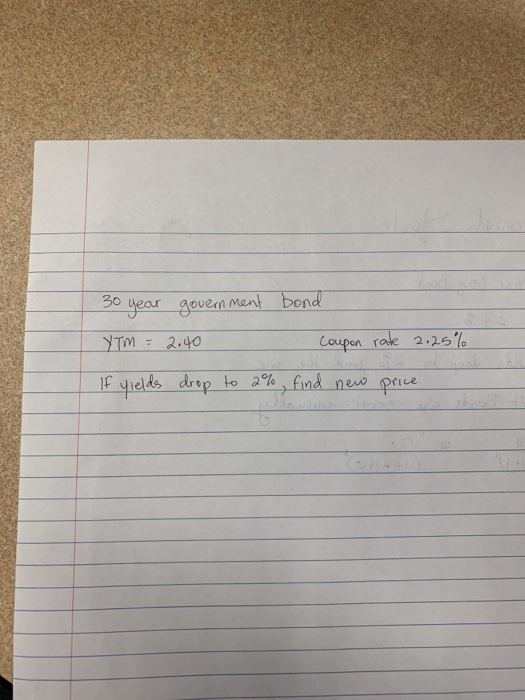

Ytm zero coupon bond. Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula... Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. This calculator can be used to calculate the effective annual yield or yield to maturity (YTM) of investment in such bond when the bond is held till maturity. Purchase Price of Bond

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond Questions and Answers - Study.com View Answer. Compute the yield for a $1000 face value zero coupon bond that sells currently for $280 and matures in 20 years. View Answer. Compute the issue price of each of the following bonds. a. $10,000,000 face value, zero-coupon bonds due in 20 years, priced on the market to yield 8% compounded semiannually. b. Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

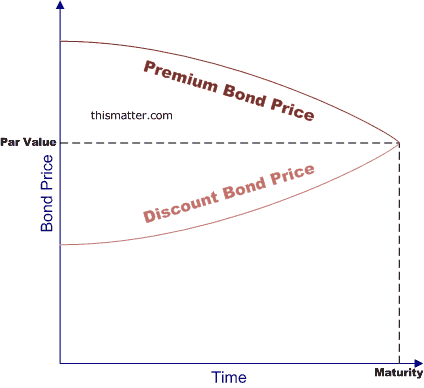

Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ... CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube #zerocouponbond #deepdiscountbond #howtocalculateyieldondeepdiscountbond for video of zero coupon bond click here for video of bond & debentures - introduction click... Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity; The n is the number of years from now until the bond matures. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Bond Yield to Maturity (YTM) Calculator - DQYDJ A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Par Value: $1000 Years to Maturity: 3

Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg Round your answer to 2 question the yield to maturity on 1 year zero coupon bonds is currently 5 the ytm on 2 year zeros is 6- the treasury plans to issue a 2 y

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity If...

Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ...

How to calculate yield to maturity in Excel (Free Excel Template) You will want a higher price for your bond so that yield to maturity from your bond will be 4.5%. Let's calculate now your bond price with the same Excel PV function. =-PV (4.50%/4, 4*10, 1500, 100,000) = $112,025.59. So, you will be able to sell your bond at $112,025.59 with a premium of amount $12,025.59.

Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

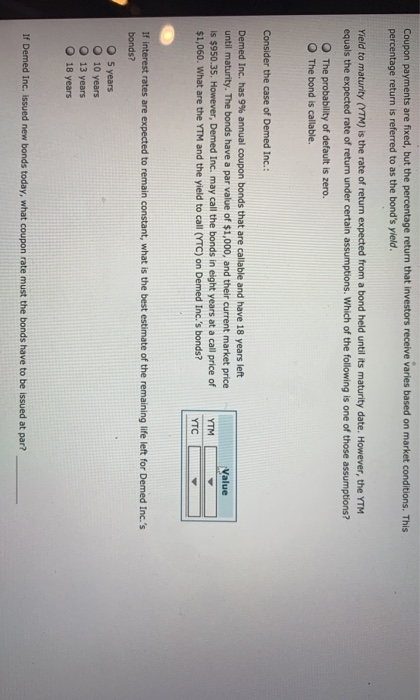

The stated yield to maturity and realized compound yield to | Quizlet In which one of the following cases is the bond selling at a discount? (1) Coupon rate is greater than current yield, which is greater than yield to maturity. (2) Coupon rate, current yield, and yield to maturity are all the same. (3) Coupon rate is less than current yield, which is less than yield to maturity.

Solved What is the YTM of a twenty-year zero coupon bond - Chegg Expert Answer. 5.54% Face value of bond is $ 1000 which is paid at the end of maturit …. View the full answer. What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68%.

YTM for a zero coupon bond? | Forum | Bionic Turtle While solving one of the questions i came to a section where I was to calculate the YTM of a zero coupon bond. i had the term and the price of the bond. Thinking that zero coupon bond has just one payment, i calculated the discount rate using term, par value and the price. To my surprise the value that I got was different to what my calc gave me..

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1; Zero-Coupon Bond Risks

What is the yield to maturity (YTM) of a zero coupon bond with a face ... YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 -> Nper that is the number of payments in this case 8.

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube - Otosection Calculating yield to maturity on a zero coupon bond. ytm = (m p) 1 n 1. variable definitions: ytm = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) m = maturity value; p = price; n = years until maturity; advantages of zero coupon bonds. most bonds typically pay out a coupon every six months.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

:max_bytes(150000):strip_icc()/YTM-ba4cbe49e854427ca467a11ef9d2dd63.jpg)

Post a Comment for "39 ytm zero coupon bond"